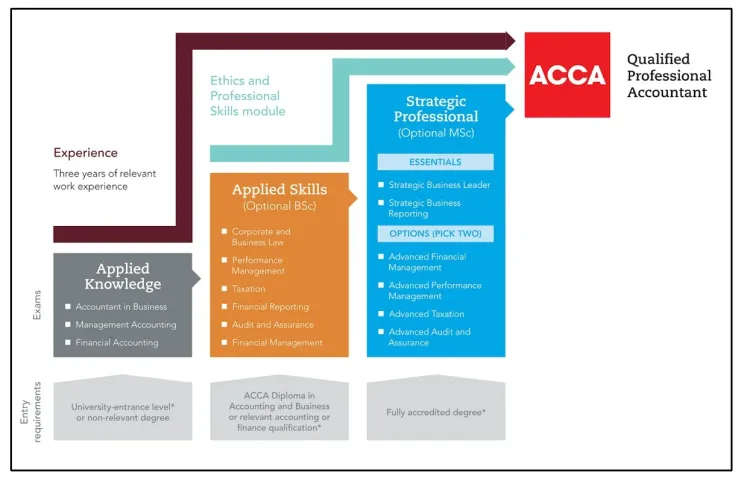

The ACCA syllabus isn’t just a random mix of topics for passing exams. It’s been structured to build knowledge step by step. Each group of ACCA subjects adds something to how someone works and thinks in a finance role. It starts with the basics in accounting, business, and finance, moves into areas like analysis, control, reporting, and decision-making, and ends with practical subjects at the professional level where answers depend on how well someone can apply what they’ve learned.

Applied Knowledge Level: Foundation and Fundamentals

First level, the ACCA subjects are to give clarity on basic accounting functions and business systems. Students here often come from different educational backgrounds. These subjects aim to establish uniformity before anything else. Without a shared grasp of accounting principles and the role of finance in business, it becomes difficult to handle more advanced topics later.

This level includes three core ACCA subjects:

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

Business and Technology covers how organisations are structured, how they operate, and how accounting fits into day-to-day business functions. Management Accounting looks at how costs are tracked, how budgets are set, and how performance is measured across different parts of a business. Financial Accounting focuses on preparing financial statements using international rules and standards.

These three areas focus more on knowledge than application. They focus on getting the basic accounting language right. Whether it’s understanding the difference between accrual and cash basis or identifying control systems in an organisation, this level sets the tone for what follows.

Applied Skills Level: Technical Competency and Depth

In the Applied Skills level, the ACCA syllabus begins to stretch students beyond terminology and concepts. Students start working through real financial reporting standards, audit procedures, tax rules, financial analysis models, and management decision-making.

The six ACCA subjects at this level are:

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

Corporate and Business Law brings in the legal side of finance, covering contracts, responsibilities, and rules that apply to business. Performance Management continues from Management Accounting, taking things further with variance analysis, budgeting when outcomes aren’t fixed, and how performance is reviewed. Taxation deals with how tax applies to individuals and businesses, based on the rules set in different regions.

Financial Reporting builds on the basics of Financial Accounting by using real examples to apply international standards, including areas like leases and group accounts. Audit and Assurance brings in how audits are planned and carried out, what kind of evidence is collected, and how external reviews are handled. Financial Management covers how investment decisions are made, how funding is managed, and how businesses plan around costs and returns.

Subjects at this stage shift away from just learning rules and focus more on making sense of situations, applying judgement, and working through financial details with care. Candidates are expected to link decisions with financial consequences. There’s also a subtle shift from accounting work to advisory work. While they are not labelled as consultants, students begin to handle questions that require weighing financial outcomes, identifying weaknesses in control systems, or presenting suitable funding strategies.

Strategic Professional Level: Application and Judgment

Once candidates reach the Strategic Professional level, the ACCA syllabus expects them to think more like senior finance professionals. Instead of simply preparing reports, the expectation shifts to analysing those reports, drawing implications, and influencing business actions. The ACCA subjects at this level are designed to simulate real-world decisions under business pressure.

This level is split into two compulsory subjects and four optional subjects. Candidates must complete the two core papers:

- Strategic Business Leader (SBL)

- Strategic Business Reporting (SBR)

SBL merges leadership, governance, risk, technology, and financial strategy. The exam style is different from earlier ones because it’s structured as a business case with supporting exhibits, and answers require both financial and non-financial judgment. Strategic Business Reporting continues where Financial Reporting left off but brings in ethics, stakeholder communication, and accounting policy choices. The key here isn’t just technical accuracy but judgment & transparency in applying standards.

So the optional papers here are:

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance (AAA)

This level brings in financial management topics like risk, funding options, and how businesses are valued across markets. Performance management moves into real-world business measurement, using both financial results and practical outcomes. Taxation includes handling both personal and corporate cases, working through real planning situations while staying within the rules. Audit and assurance puts the student in charge of running the full audit process, from spotting where issues might come up to deciding what the final report should say.

By the time someone finishes these subjects, they are not learning new concepts from scratch. Instead, they are applying everything built in the previous levels. The tasks mimic real-life boardroom challenges, where decisions are not binary, and where multiple factors have to be balanced.

How the Subject Transition Helps Career Progression

From junior analyst to senior financial controller, the ACCA syllabus mirrors the actual layers of growth in a finance career. The early ACCA subjects build fluency in recordkeeping and transactions. The mid-level subjects connect that fluency to systems, laws, tax rules, and business models. The final level links everything to decision-making and external communication.

This structure also allows employers to align roles with qualification levels. Candidates who’ve completed only the first six subjects can start in data entry or accounts assistant roles. Those who’ve completed Applied Skills can handle reporting, forecasting, or budgeting work. And those at the Strategic Professional level can support or lead teams in advisory or senior finance positions.

Final Thought

ACCA’s syllabus does not evolve randomly. Each subject fits into a broader skill-building timeline. Instead of rushing through exams, many students benefit more from pausing between levels, reflecting on what each subject really changes in the way they think and work. Some subjects may seem disconnected at first glance, but their influence becomes clear when applied in live business cases, especially at the Strategic Professional level.

For those looking to build both exam confidence and real-world thinking through every stage of the ACCA syllabus, Zell Education structures its learning around application rather than memorisation, supporting learners from their first paper to their last.

Read Also: Unleashing the Power of Words: Strategies for Crafting Compelling Essays